Business Insurance in and around Wilson

Wilson! Look no further for small business insurance.

Insure your business, intentionally

Help Prepare Your Business For The Unexpected.

Being a business owner isn't easy. You want to make sure your business and everyone connected to it are covered in the event of some unexpected problem or loss. And you also want to care for any staff and customers who hurt themselves on your property.

Wilson! Look no further for small business insurance.

Insure your business, intentionally

Surprisingly Great Insurance

Planning is essential for every business. Since even your most detailed plans can't predict natural disasters or consumer demand. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance protects more than just your facility or shop.. It protects your future with coverage like errors and omissions liability and extra liability. Terrific coverage like this is why Wilson business owners choose State Farm insurance. State Farm agent Justin Murray can help design a policy for the level of coverage you have in mind. If troubles find you, Justin Murray can be there to help you file your claim and help your business life go right again.

So, take the responsible next step for your business and contact State Farm agent Justin Murray to investigate your small business insurance options!

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

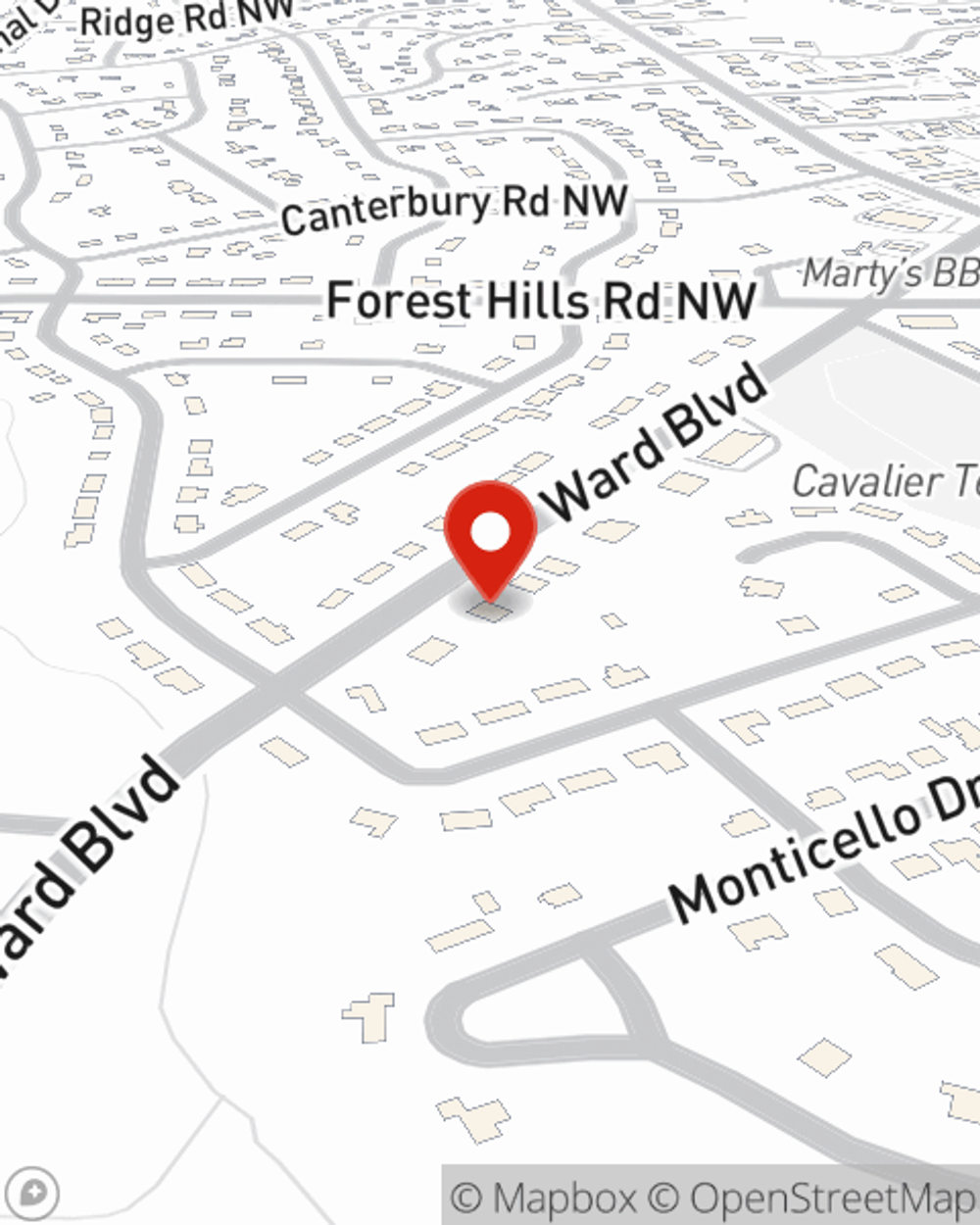

Justin Murray

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.